qstockmedia - Fotolia

New CDN services give providers an edge in WAN marketplace

With enterprises moving workloads to public cloud, the CDN services market could see growth in security and performance services, as providers exploit their network-edge locations.

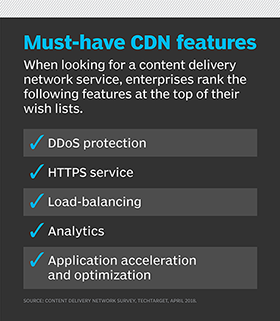

Enterprise demands for better performance and security from their public cloud connections are driving growth in the content delivery network services market, according to a recent Gartner report. By rolling out new services that capitalize on existing CDN architecture at the network edge -- close to users -- CDN providers are going head-to-head with vendors offering their own premises-based application performance and security products.

At the same time, as content delivery networks become a more strategic business choice and not merely a website caching option, an expanded CDN services mix is causing enterprises to re-evaluate their CDN deployment strategies.

The push to add ancillary services comes as enterprises ask CDN providers to go beyond caching content at the network edge -- the traditional CDN business model -- to provide value-added services from their global points of presence, according to Ted Chamberlin, Gartner's research vice president of cloud service providers, who wrote the report.

CDN providers moving into a new competitive space

Providers offering new CDN services have a shot at winning enterprise business away from virtual and hardware device vendors selling WAN optimization and application delivery controller services, Chamberlin said.

"I honestly think the biggest threat to edge routing and switching, and even traditional firewalls in DDoS [distributed denial-of-service] devices, is from CDNs that can really take away that market," he said. "It's only recently they have woken up and realized that they can fairly easily supplant the WAN edge device market."

The emerging software-defined-WAN market isn't as much at risk, because CDNs don't extend to enterprise WAN locations, Chamberlin added. Part of the SD-WAN value proposition is that services extend to a corporate enterprise's demarcation point, while CDNs go to where they can have a critical mass of network backflows.

"I think they [SD-WAN providers] are going to find ways to coexist with the CDN providers," Chamberlin said. "The hardware guys are going to be the most pressured."

Revenue shifts, as ancillary service market changes

Gartner projected revenue from traditional CDN caching services will grow only slightly in the next five years, while sales from related web optimization, application performance and security services multiply -- offering CDN providers a natural extension of their existing business model. And because CDN networks are so well-placed, capabilities such as network analytics services based on machine learning and artificial intelligence could also be added to the mix.

Gartner plans to release new CDN market projections later this year. A CDN market study from MarketsandMarkets, meantime, projected CDN services to grow from $7.5 billion in 2017 to $30 billion over the next five years, largely due to content delivery network providers turning on security, compression, web optimization and data duplication features that already exist in their networks.

"As companies move web-facing work to public clouds, CDNs really got a bump in growth and became more nimble," Chamberlin said. "They became sort of the next thing you did after you deployed web infrastructure out of public clouds."

CDN services address changing market

Recent venture capital financing interest has also encouraged providers to launch CDNs that specialize in serving different segments of the market -- such as those focusing on high-bandwidth services, like video and broadcast media. New security and content optimization services are a natural follow-on, Chamberlin said.

As a result, CDN pricing could vary drastically in the next few years, Chamberlin said. Gartner projects, by 2020, revenue from value-added services will comprise the bulk of CDN providers' balance sheets. He added, at the same time, 60% of CDN providers will charge their customers for value-added services only -- a dramatic shift from today, where charging for caching and optimization represent the lion's share of their revenue.

"When companies deploy websites, usually, the next thing they do is deploy a CDN to get their content as close to users as possible," Chamberlin said. The strategic deployment of CDNs -- based on hundreds of thousands of caching, compute and storage nodes in data centers around the world -- make them logical providers of ancillary services, he said.

"The aha moment came when CDN providers realized they could offer so much more than webpage acceleration. Functions like duplication of data, compression and caching were all things that individual devices did in a discreet manner. CDNs already have that deployed at their PoPs [points of presence] and can just turn those features on for customers," he said.

Who buys CDN services in the enterprise?

The role CDNs play in enterprise digital transformation strategies is also changing the notion of who buys CDN services, Chamberlin said. Slowly, but surely, business units are starting to drive the conversation, because they have requirements for their websites, encompassing web apps, streams and other content.

"It used to be the director of networking or engineering -- anyone who understood enterprise network architecture or had the responsibility to see that enterprise applications ran well," Chamberlin said of the person who formerly made CDN buying decisions. As CDNs become a more strategic tool, it's likely that a chief digital officer or even a chief information security officer may be the one who decides, Chamberlin said.