Indoor 5G gets a boost as small cells come to rescue

Indoor small cells are becoming more common in consumer and enterprise markets. Along with distributed antenna systems and Wi-Fi networks, small cells increasingly enable RF coverage.

5G offers faster download speeds than previous cellular standards, but the technology might not offer anywhere near the coverage of 3G and 4G networks, depending on the frequencies the base stations use.

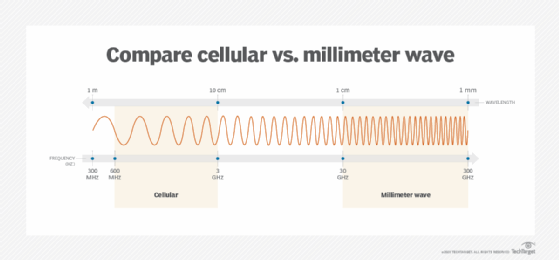

5G operates in three frequency bands, each with its own benefits and challenges:

- Low-band 5G operates from 600 MHz to 900 MHz.

- Midband 5G operates from 1 GHz to 6 GHz.

- High-band 5G operates from 24 GHz to 40 GHz.

Low-band 5G is slower than midband and high-band 5G, but its longer wavelengths enable it to travel farther and penetrate through obstacles such as walls or glass. Midband 5G, or sub-6 5G, provides more capacity than low-band 5G and more geographic coverage than high-band. High-band 5G is ideal for fast speeds, but it can't cover large distances due to its short wavelengths.

High-band 5G also uses millimeter wave (mmWave) frequency bands at 30 GHz to 300 GHz. While mmWave spectrum offers promising speeds, it struggles with signal interference, attenuation, degraded capacity and object penetration. These drawbacks prevent the wireless high-band technology from working well indoors.

In fact, since AT&T and Verizon first deployed mmWave 5G, users have found it difficult to access high-band 5G signals. While users can get fast mobile 5G download speeds of more than 1 Gbps if they're outdoors and close to a 5G cell tower, this isn't always possible for those in an office or working from home.

As a result, most carriers have purchased the right to use frequency bands in all three spectrum bands to broaden their 5G coverage.

Small cells boost indoor coverage

Cellular small cells are another answer to this coverage problem. First introduced as part of the 3rd Generation Partnership Project 4G LTE specification in 2009, these radio access points (APs) can increase the density of a cellular network.

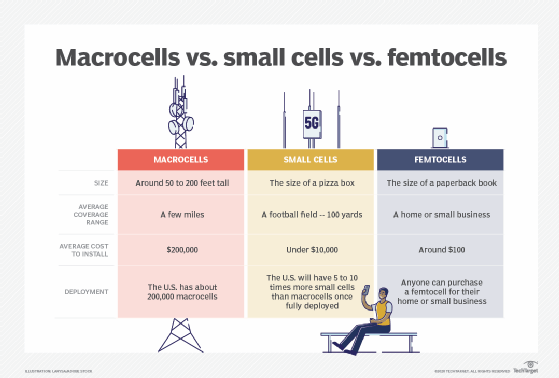

A small cell is a low-powered cellular base station that operates using a variety of frequencies. Depending on their size, small cells can offer a transmission range from 40 feet up to a few kilometers. These mini base stations link back to the main cellular network via an Ethernet, fiber or wireless connection.

Small cells can be deployed indoors or outdoors. The indoor variety is generally small -- around the size of a pizza box. These megabit- or gigabit-speed gadgets can be installed on the ceilings and walls of homes and offices to boost the radio frequency (RF) signal strength of cellular networks.

5G networks are becoming increasingly dependent on indoor small cells. This trend is likely to continue as more 5G small cells are deployed in offices, homes and apartments.

Carrier developments in the indoor 5G network space

With the deployment of low-band and midband 5G cellular networks by U.S. mobile network operators (MNOs), indoor access to 5G technology is becoming more commonplace.

The three major MNOs in the U.S. -- AT&T, T-Mobile and Verizon -- now offer a mixture of low-, mid- and high-band 5G networks, with 5G coverage gradually expanding across the U.S. It can take an MNO anywhere from 12 to 18 months to add new micro 5G sites. Any infrastructure that can be deployed in less time is an advantage for a carrier. Carriers are gradually building standalone 5G networks that run on true 5G cores instead of existing 4G LTE core infrastructure.

General 5G access -- indoor and outdoor -- has improved over the years as carriers have rolled out macro network infrastructure, such as macrocell base stations. While small cell deployment has been slower than expected -- due to carrier focus on macro networks -- major carriers are deploying small cells to broaden and intensify coverage as the cellular 5G network expands.

Verizon

Verizon, the largest U.S. MNO, leased 15,000 small cells from shared communications infrastructure provider Crown Castle to support its nationwide 5G deployment through 2025. The lease on each 5G radio lasts 10 years. This deal supplements the thousands of 5G small cell sites Verizon has built itself. Verizon is also deploying small cells that are compatible with C-band spectrum, which operates between 3.7 GHz and 3.98 GHz.

The operator bought licenses for frequency bands in low-, mid- and high-band spectrum, with a focus on its mmWave frequencies at 28 GHz and 39 GHz and C-band spectrum. Verizon's 5G Ultra Wideband service largely relies on C-band and covers 200 million customers in the U.S.

T-Mobile

The second largest U.S. mobile operator T-Mobile also signed a deal with Crown Castle to deploy 35,000 small cells through 2027. The lease on the units runs for 12 years.

T-Mobile relies primarily on low-band spectrum at 600 MHz for its 5G coverage, called Extended Range 5G. Another important component of T-Mobile's 5G strategy is the midband spectrum at 2.5 GHz it received from merging with Sprint in 2020. T-Mobile's Ultra Capacity 5G combines its midband and mmWave frequencies and covers 260 million customers in the U.S.

AT&T

The third-ranked MNO, AT&T, has tried to cut down the time it takes to acquire sites and permits to deploy small cells. AT&T has field-tested and is deploying commercially available Ericsson Street Radio 4402 small cells in multiple U.S. cities. The carrier, however, hasn't said how many indoor or outdoor small cells it plans to deploy.

AT&T offers low-band 5G that covers 290 million customers in the U.S., while its 5G+ service uses a combination of midband and mmWave spectrum.

How do small cells aid 5G indoor coverage?

Despite plans from major MNOs, private enterprises will deploy the majority of 5G small cells. IDTechEX predicted that 45 million 5G small cells will be distributed globally by 2031.

Some of these small cells will be installed by companies looking to create their own private 5G network for business use cases. For example, according to Small Cell Forum, manufacturing, utility, energy, retail and transportation companies are the biggest investors in small cells because of their need to support large geographic areas. By combining a private 5G core with a small cell network, enterprises can implement a secure, reliable, low-latency and high-speed private network on premises.

Despite all the hype about private 5G, it won't become more mainstream until 2025 or 2026. In the meantime, enterprises continue to install indoor small cells, albeit with the micro radios connected to an MNO's public network.

Increasing 5G network densification will greatly improve indoor coverage. As noted, indoor environments are not particularly friendly to high-band mmWave 5G radios. Walls can block high-band signals entirely, but even midband 5G RF can be weakened by office partitions and furniture.

Enterprises that require their employees to have access to high-speed -- 1 Gbps-plus -- data downloads over cellular networks need multiple mmWave small cells to ensure reliable, uninterrupted data coverage indoors.

The majority of 5G small cells deployed likely use midband or low-band frequencies. These bandwidths don't totally rely on compatible indoor micro radios to provide coverage, but businesses that depend on solid 5G signals indoors should look to install midband 5G small cells to be certain.

Distributed antenna systems

Many enterprises use a distributed antenna system (DAS) to carry a cellular signal from a central source throughout a building. Small cell networks can supplement these systems for improved indoor mobile coverage.

DAS vendors, such as CommScope and Corning, work with major carriers to install indoor antenna systems in hotels, hospitals, large office buildings and stadiums. Deploying a DAS, however, is more expensive than installing one or several small cells in a building, with costs dependent on supported frequencies and equipment, according to Waveform, a cell signal boosting provider.

Wi-Fi 6

Many smaller businesses can use Wi-Fi to provide indoor mobile coverage for employees, particularly because most cellphones available these days support Wi-Fi calling. Modern Wi-Fi 6 -- 802.11ax -- APs increase throughput and decrease the congestion of public network bandwidth. Compared with previous Wi-Fi standards, Wi-Fi 6 interoperates better with 5G services, enabling a more heterogeneous network when using both technologies.

Key players in the indoor 5G space

Prominent vendors in the 5G small cell market include the following, in alphabetical order:

- Airspan.

- Cisco.

- CommScope.

- Ericsson.

- NEC Corp.

- Nokia.

- Samsung.

The blocklisting of Chinese vendors Huawei and ZTE Corp. in 2019 has splintered the global radio access network market, including small cells. In the U.S. and parts of Europe, Chinese vendors are banned from selling telecom infrastructure. In the rest of the world, Huawei is the top telecom vendor.

Editor's note: This article was originally written by Dan Jones and updated to reflect industry changes.